If You’ve Been Wondering About What Happened To GameStop And On The US Stock Exchange A Few Weeks Ago, Then This Is The Simplest Explanation You Can Find Anywhere.

To start with, there’s a community called WallStreetBets on Reddit (a forum like Nairaland).

And the common discussion on WallStreetBets is financial investments and the stock market.

So, a group of users managed to find out a hedge fund called Melvin Capital had taken a substantial short position in GameStop (a gaming company).

But what’s a hedge fund?

A hedge fund is simply a group of people polling their funds together and letting an investment manager manage this money by using it to invest in different ways or categories.

And what’s a short position?

A short position is simply predicting the price of a company’s stock would go down.

Say the current price of rice is N25,000 and I believe it will go down to N12,000 in a few weeks. Maybe because I have some information about the harvest season or inside information from the Ministry of Agriculture or whatever.

But then I don’t even have a single bag of rice. So, what do I do?

I go to my friend Chinedu and ‘borrow’ his bag of rice on credit. I sell it for N25,000 and hope to buy it back in a few weeks when it goes down to N12,000 or less and return it to Chinedu.

Now the upside of taking a short position is limited, but the downside? Infinitely limitless.

And what does that mean?

Let’s say supposing the bag of rice doesn’t go down to as much as N12,000, I still make a profit (N25,000 minus whatever I sell it for). If it goes below N12,000, I simply make more.

But what if the price never goes down and instead keeps going up?

What if the bag of rice becomes N30,000? Buying the bag of rice and returning to Chinedu will cost me a loss of N5,000.

What if it becomes N32,000 or N45,000 or even N50,000 or N75,000?

I’m bleeding heavily from the losses at this point.

Now, conventional wisdom will advise I hold on and wait for the price to go down. But what happens when Chinedu wants his bag of rice?

The few weeks I promised him is up already and I’m supposed to return it. Or maybe he hears about the increase and decides to cash in by selling. Or maybe his wife and children are hungry and he needs his bag of rice to feed them.

What do I do?

It’s none of Chinedu’s business. I just have to find a way to return his bag of rice however I deem fit.

This is exactly what happened to Melvin Capital.

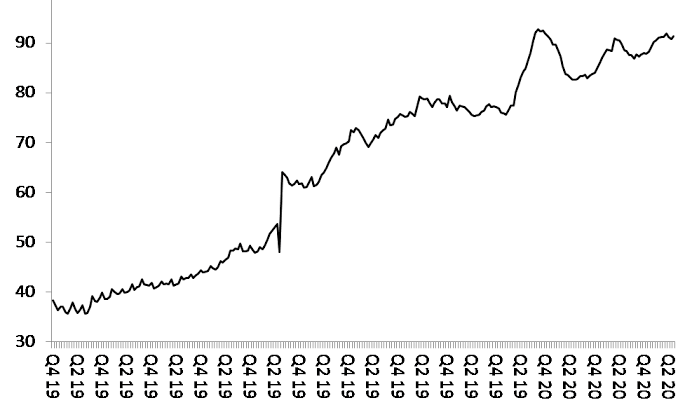

Because GameStop stocks had been falling for quite some time, they were betting on the idea the stocks would keep going down.

Knowing this, retail traders from WallStreetBets piled into the stock.

And the result was simple. As usual, when lots of people are buying into a particular stock, the prices go up.

In this instance, the stock prices would go up causing Melvin Capital to lose their money and the traders to gain. But that’s not where it even ends.

A short squeeze will also happen.

This is when those who bet against the stock are forced to buy back into their positions to avoid losing more money. And what then happens? The stock’s price keeps rising like yeast 😁

At this point, the guys on WallStreetBets are turning thousands of dollars to millions.

Whereas Melvin Capital will go on to lose their initial short position of $55 million and still incur more losses of up to $2 billion before being bailed out by another hedge fund.

Spectacular something I tell you!

This is the point where Chinedu reports me to his DPO friend at Maroko Police Station and I’m forced to sell my car just to return his bag of rice.

Another spectacular something! 😁

Well, the truth is shorting despite how many billionaires it has made is crazily risky. Simply because it has a limited upside but an infinite bottomless downside. And everyone hopes the price of the stocks they’ve bought will keep going up, but there are a couple of reasons why you might decide to take a short position.

It could be intuition. Or it could be inside information. Or it could be forecasting based on management or product rollout or government policies. Or just plain old prediction. There’s a lot of reasons. But it’s crazily risky.

GameStop went from around $3 in early 2020 to over $300 a few weeks ago. It’s now trading at around $50. A crazy rise and fall.

So, be careful out there, kids.

Leave a comment